Owning along Florida’s Emerald Coast is a privilege—and a major investment. But when property values climb, so can your tax bill. If your property’s tax evaluation feels a little… inflated, the good news is you don’t have to just accept it.

In Walton County, you have until September 15 to challenge your tax evaluation. Miss the deadline, and you’re stuck with the bill for the year.

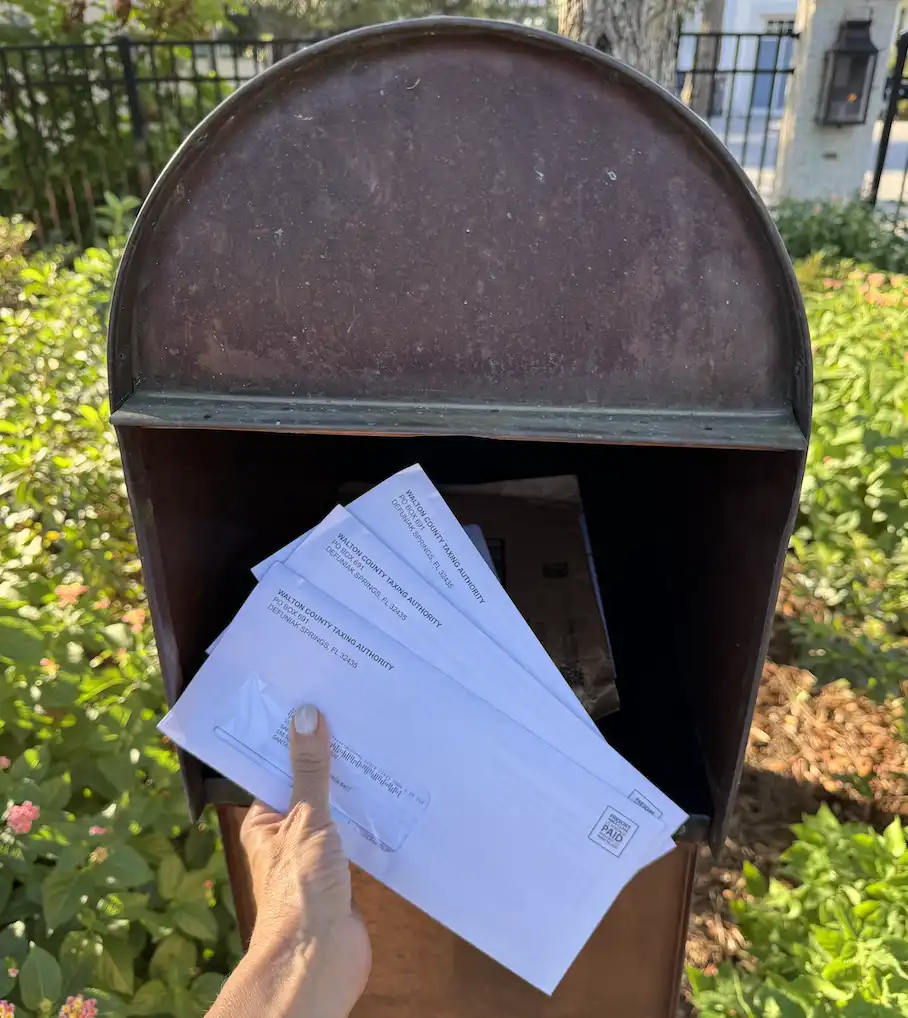

Why You Should Be Checking Your Mail

The Property Appraiser’s office mails out your TRIM notice (Truth in Millage) every August. It’s their best estimate of your home’s market value. Sometimes it’s spot on. Sometimes it’s off—way off.

An overstated value means you’re paying more tax than you should. And for higher-end homes along 30A and beyond, that difference adds up fast.

Your Next Steps:

- Read Your TRIM Notice – Don’t toss it with the junk mail right beside the coupons. Your property value and estimated taxes are right there in black and white.

- Compare to Reality – Look at recent sales in your neighborhood, talk with a trusted advisor (A Bailey Advisory agent!), or check your most recent appraisal. If the property appraiser’s number is higher than the true market value, you have a case.

- File Your Petition – Submit with the Walton County Clerk of Courts before the September 15 deadline. There’s a small filing fee, but the savings can far outweigh it.

- Bring Proof – Recent sales, appraisals, photos—this is your chance to show why the county’s number doesn’t add up and potentially lower your tax obligations.

- Attend the Hearing – The Value Adjustment Board will review everything and make the final call.

BAG Tip

Think of this like defending your investment portfolio. Every dollar you don’t overspend on taxes is a dollar you can reinvest in property upgrades, another home, or, let’s be real—enjoying your favorite 30A Libation on the beach!

Final Word

September 15 is a hard deadline. No extensions, no do-overs. If you even think your Walton County evaluation is too high, now is the time to act.

At Bailey Advisory Group, we know the luxury market here inside and out. If you’d like a quick market check to see if your property was fairly assessed, reach out. A 10-minute conversation could save you thousands and be the reason you can get that new couch or grill you’ve been eyeing with the money you save..

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).